The credit card industry has been growing rapidly recently, and thus huge numbers of consumers’ credit data are collected by the credit department of the bank. The credit scoring manager often evaluates the consumer’s credit with intuitive experience.

The best solution is to use OneHotEncoding for categorical attributes. Have a look at implementation of OneHotEncoding on sklearn on this link. After you convert these categorical data into OneHotEncoded data. It will be like for first attribute the values are A11, A12, A13, A14.

So lets say we have training example that starts with A12. It will be converted into 0 1 0 0 in OneHotEncoding.

You can similarly convert for all categorical attributes. For numerical data, normalize them to zero mean and standard deviation of 0.01. Although this step is not compulsory, but machine learning algorithms perform good on the normalized data. For the categorical attributes with two values, the best is to give them +1 and -1 Encoding.

Once you do this for training data, you can easily import using pandas and differentiate between training data (all columns except last) and training label(last column). Then you can train using sckikit learn.

I applied this strategy and for me RandomForestClassifier with 100 trees gave the best performance of 80% accuracy on 100 validation dataset that I separated from the training data.

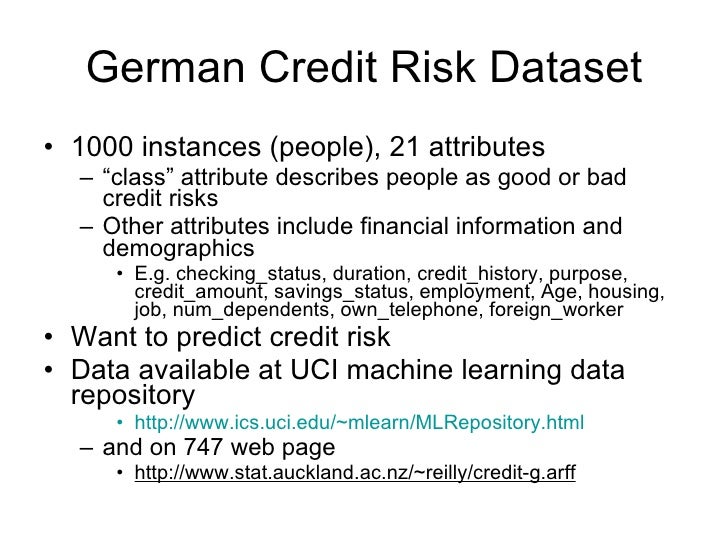

Modeling is one of the topics I will be writing a lot on this blog. Because of that I thought it would be nice to introduce some datasets that I will use in the illustration of models and methods later on. In this post I describe the, very popular within the machine learning literature. This dataset contains rows, where each row has information about the credit status of an individual, which can be good or bad.

Besides, it has qualitative and quantitative information about the individuals. Examples of qualitative information are purpose of the loan and sex while examples of quantitative information are duration of the loan and installment rate in percentage of disposable income. This dataset has also been described and used in and is available in R through the caret package.

Dasar dasar jurnalistik pdf download windows 7. Require(caret) data(GermanCredit) The version above had all the categorical predictors converted to dummy variables (see for ex. Section 3.6 of ) and can be displayed using the str function: str(GermanCredit, list.len=5) 'data.frame': 1000 obs. Of 62 variables: $ Duration: int 6 48 12. $ Amount: int 1169 5951 2096. $ InstallmentRatePercentage: int 4 2 2. $ ResidenceDuration: int 4 2 3. Mga halimbawa ng tukang pastoral tungkol sa guidance. $ Age: int 67 22 49.

[list output truncated] For data exploration purposes, I also like to keep a dataset where the categorical predictors are stored as factors rather than converted to dummy variables. This sometimes facilitates since it provides a grouping effect for the levels of the categorical variable. This grouping effect is lost when we convert them to dummy variables, specially when a non-full rank parametrization of the predictors is used.

The response (or target) variable here indicates the credit status of an individual and is stored in the column Class of the GermanCredit dataset as a factor with two levels, “Bad” and “Good”. We can see above (code for Figure ) that the German credit data is a case of unbalanced dataset with of the individuals being classified as having good credit.